Binary Golden Strategy:Strategy based on Bollinger bands in PocketOption

Strategy based on Bollinger bands

In this trading strategy, Bollinger bands are used. This indicator is quite easy to use and can, similarly to trend channels, show the range of price changes in which it moves a significant part of the time. When working with Bollinger bands, moments like when the price drastically crossed the indicator border are considered as signals. Usually, in case of such a sharp exit out of the limits of its usual fluctuations, the price soon tends to return to the central line of the indicator.

Trader's actions when the signal is formed:

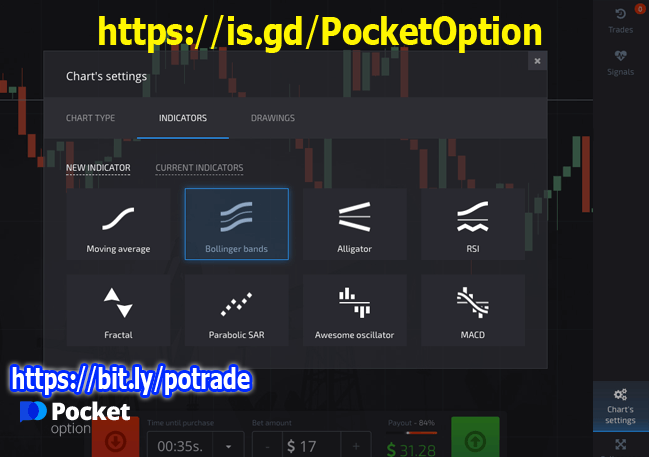

- 1) Add the Bollinger bands indicator to the chart

Adding the indicator to the chart

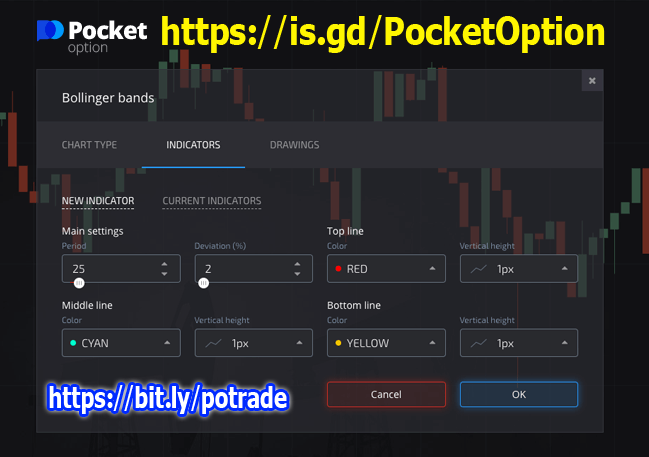

Setting up the indicator's parameters

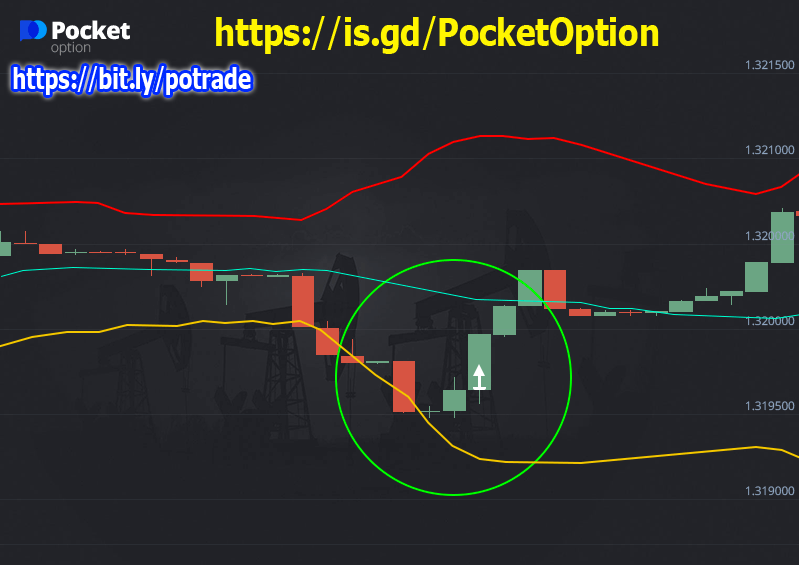

- 2) Wait for the price to go outside the indicator limits;

- 3) When the price returns to the limits of the indicator and when the confirmation candlestick is closed, you can purchase the option in the direction of the center line of the indicator.

Buy a call option when the price goes outside the lower limit of the indicator

Buy a put option when the price goes outside the upper limit of the indicator

In addition, the upper and lower limits of the Bollinger bands indicator can be used as resistance and support lines, respectively.

Trader's actions when the signal is formed:

- 1) Closing of the current candlestick occurs at the limit of the indicator;

- 2) The next candle is directed opposite to the boundary of the interval;

- 3) When the confirmation candlestick appears, you can buy an option in the direction of the center line of the indicator.

Buying a put option after a rebound from the external limit of the indicator, i.e., from the resistance line.