Traders around the world use hundreds of strategies for financial markets and binary options.This article won't list each and every one of them, but will introduce the beginners to the fundamentals of market analysis. Our team considers this to be the optimal way to successfully begin your path into the world of trading and figure out the basics of every new strategy you encounter in the future.

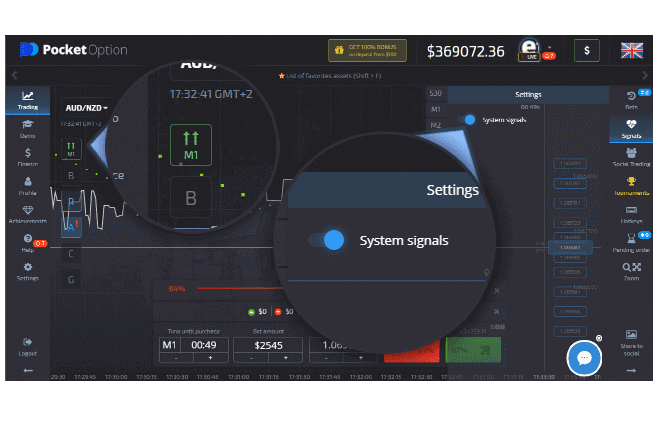

Strategies are used to receive signals to start placing trades. Thus, the signals directly depend on the selected analysis method. We will talk about four main areas of technical analysis in this article:

1. Candlestick analysis

This type of analysis uses candlestick patterns, as well as individual candles on the price chart. Different patterns can signal for either a trend reversal or its continuation. Here are some examples of candlestick analysis strategies.

Trend reversal

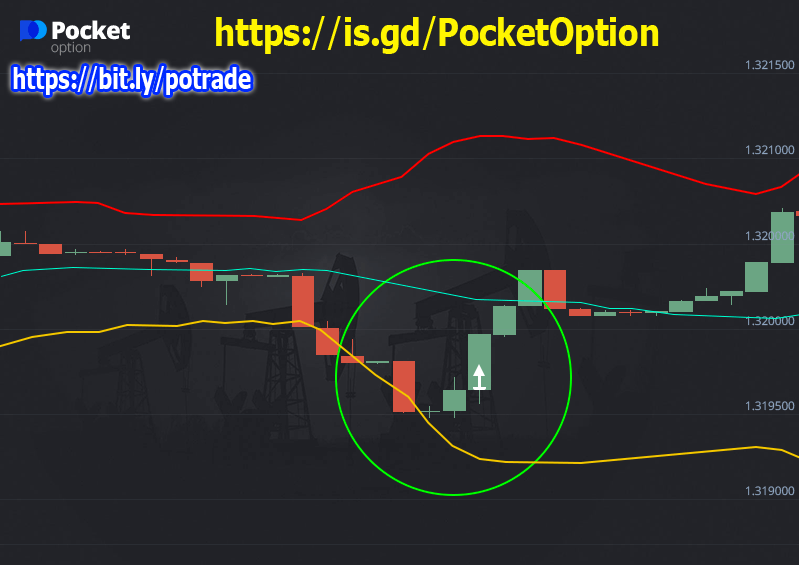

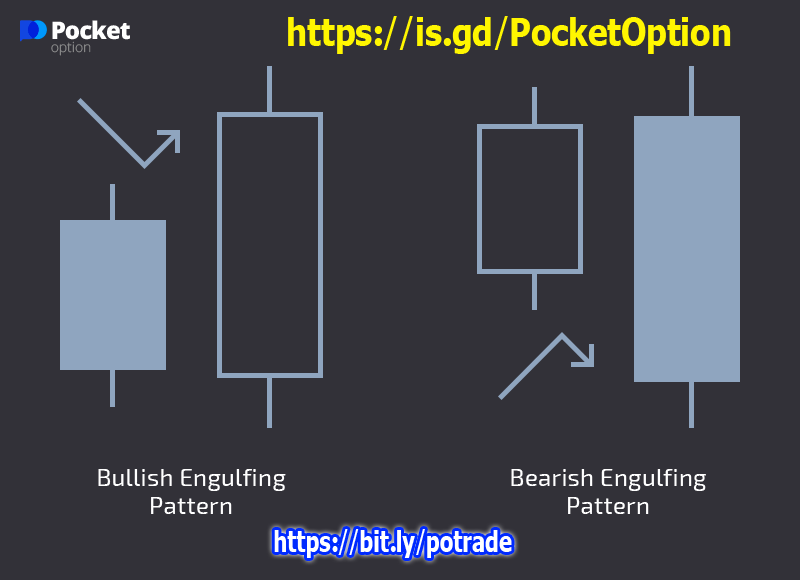

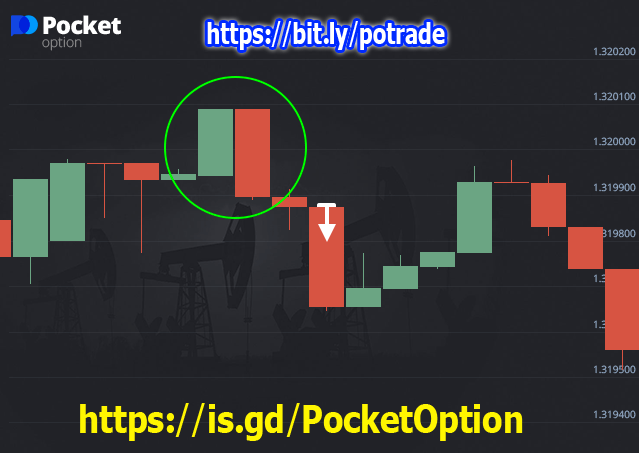

Engulfing pattern strategy - this strategy is based on the engulfing candlestick pattern and signals about a trend reversal. Look for a short candle, after which there is a longer one with an opposite direction. The second candle "engulfs" the previous one. When the pattern is formed, you have to pay attention to the direction of the following candle. If it moves in the same direction as the engulfing candle, consider opening a trade order.

Squat candlestick strategy - the upcoming reversal of a trend is often signaled by so-called squatting candles, which have small bodies and long shadows. Usually, the appearance of such a candle on the chart informs about the uncertainty of the market. There may be one or several squatting candles at in a row. When this pattern appears, it is very likely that the current trend will reverse.

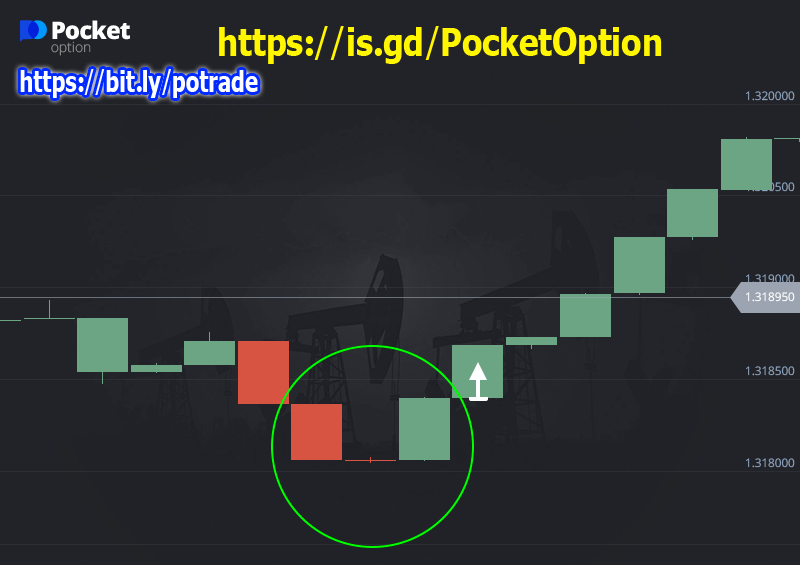

Tweezers strategy - another strong trend reversal pattern is "tweezers." It consists of two candles with different directions and the same extremes (maximum or minimum prices): during a downtrend the tweezers candles have the same minimums, during an uptrend - the same maximums. Both closing prices and shadows can act as extremes. It's worth noting that both candles that make up the pattern can be next to one another or contain one or more candles between them. The advantage is a fairly clear and strong signal. Finding tweezers as a part of any other candle pattern will enhance its effect!

Trend continuation

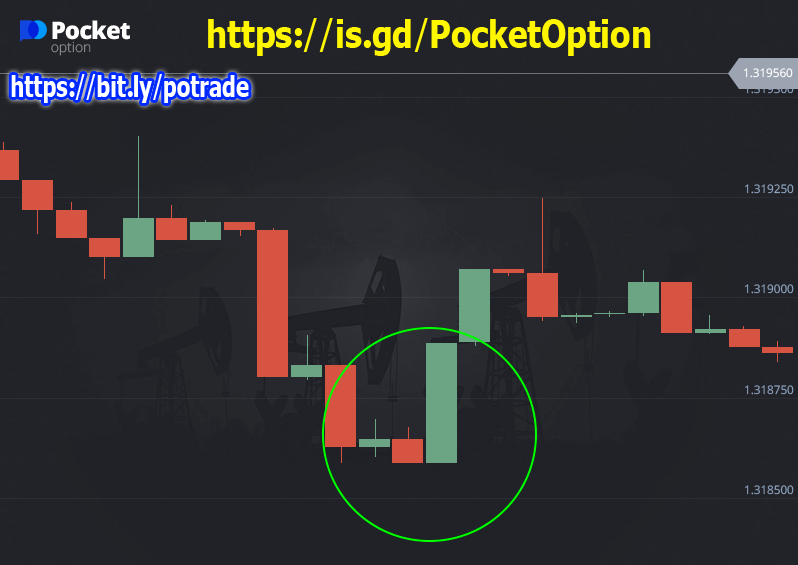

"Three methods" strategy - based on the "Three methods" pattern, the strategy acts as a signal of a trend continuation and can appear when a trend stopped its development. It consists of several candles with small bodies that follow a long one. You should pay attention to the small candles' values - they must be within the values of the long one. There also should be at least three small candles. The pattern ends with the appearance of a new long candle, which continues the trend direction. After it's closed, consider opening a trade order.

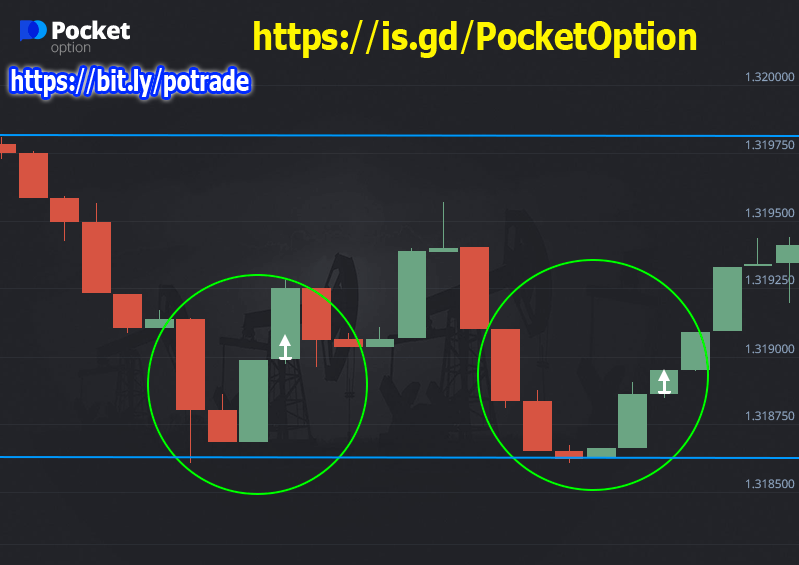

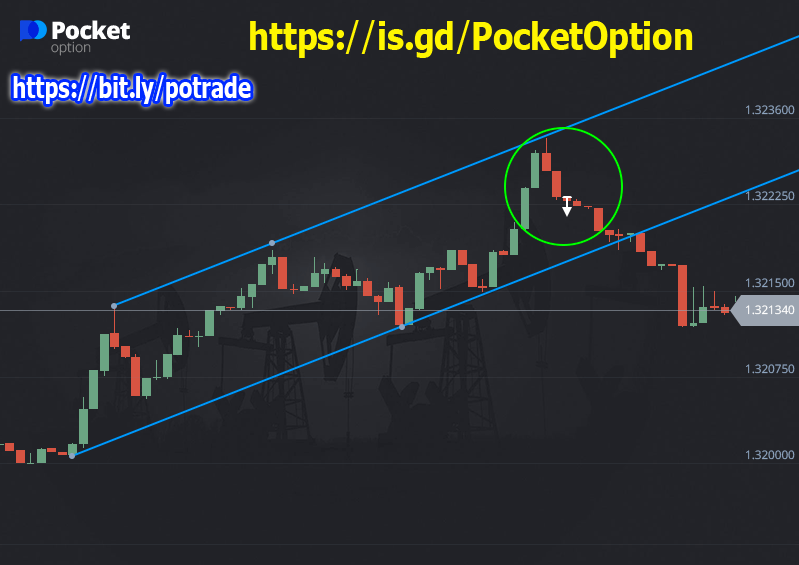

2. Power levels

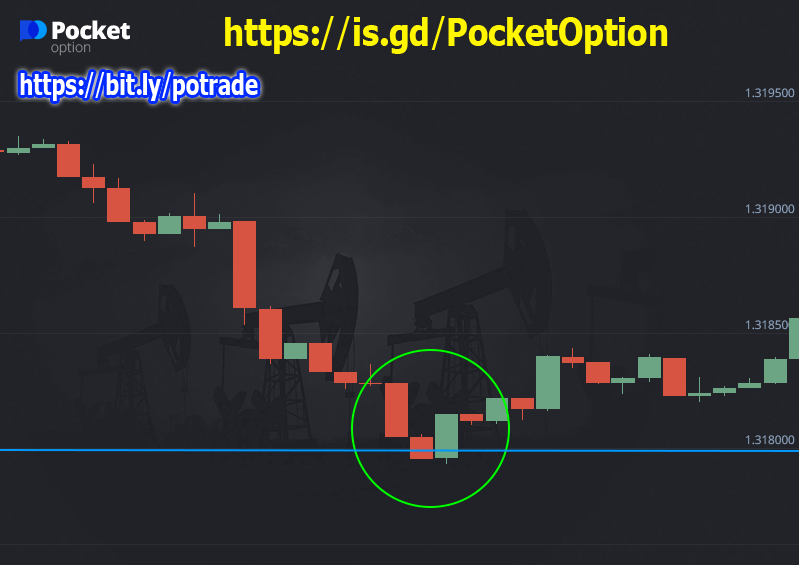

Power levels are spots on the chart where the price can stop its movement and turn around. Power levels include support or resistance levels, trend or channel lines. When the price approaches a support or resistance level it may linger near that level, or reverse its movement. Two types of trading strategies are used with force levels: breakout and bounce back.

Breakout strategy - trades can be placed when a candle closes on the other side of the current power level, "breaking" it. In this case, the chart should continue its movement in the same direction. You can place your trades only if the next candle after the level was broken continues the direction of the previous one.

Bounce back strategy - according to this strategy, trades should be placed immediately after the price changes its direction while it's close to the power level. If the candle can't break through the level, it indicates about trend reversal. The candle can touch the level with its shadow or even with its body. The signal can be strengthened by the next candle if the price continues to move away from the power level.

Breakout and bounce back strategies provide strong signals for laid back and profitable trading. In addition, they can be improved by applying candlestick analysis.

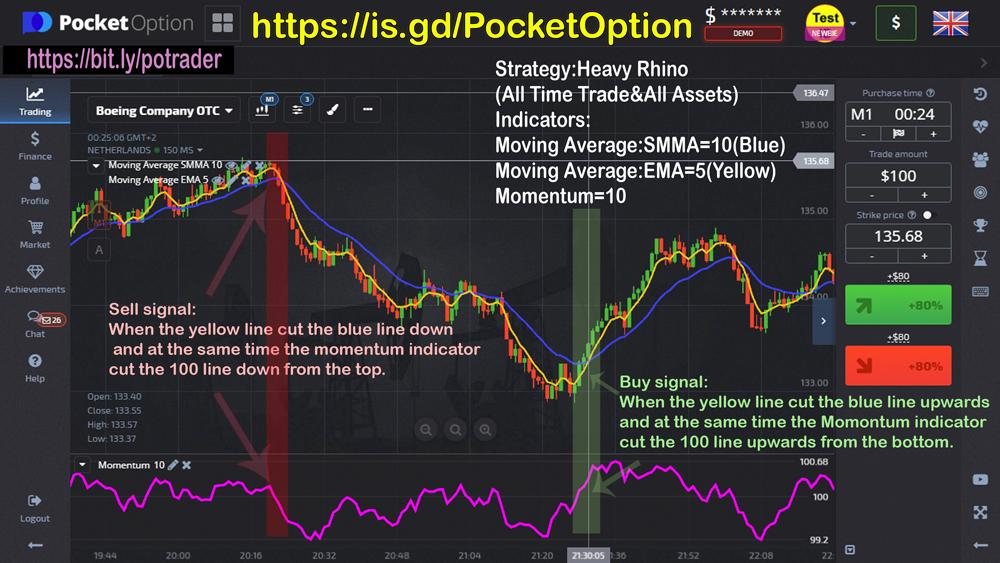

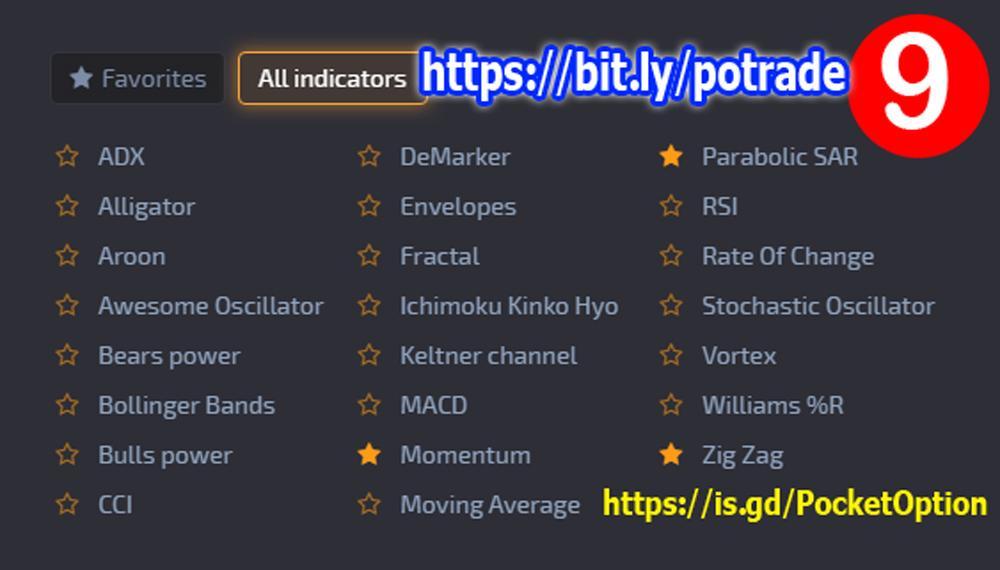

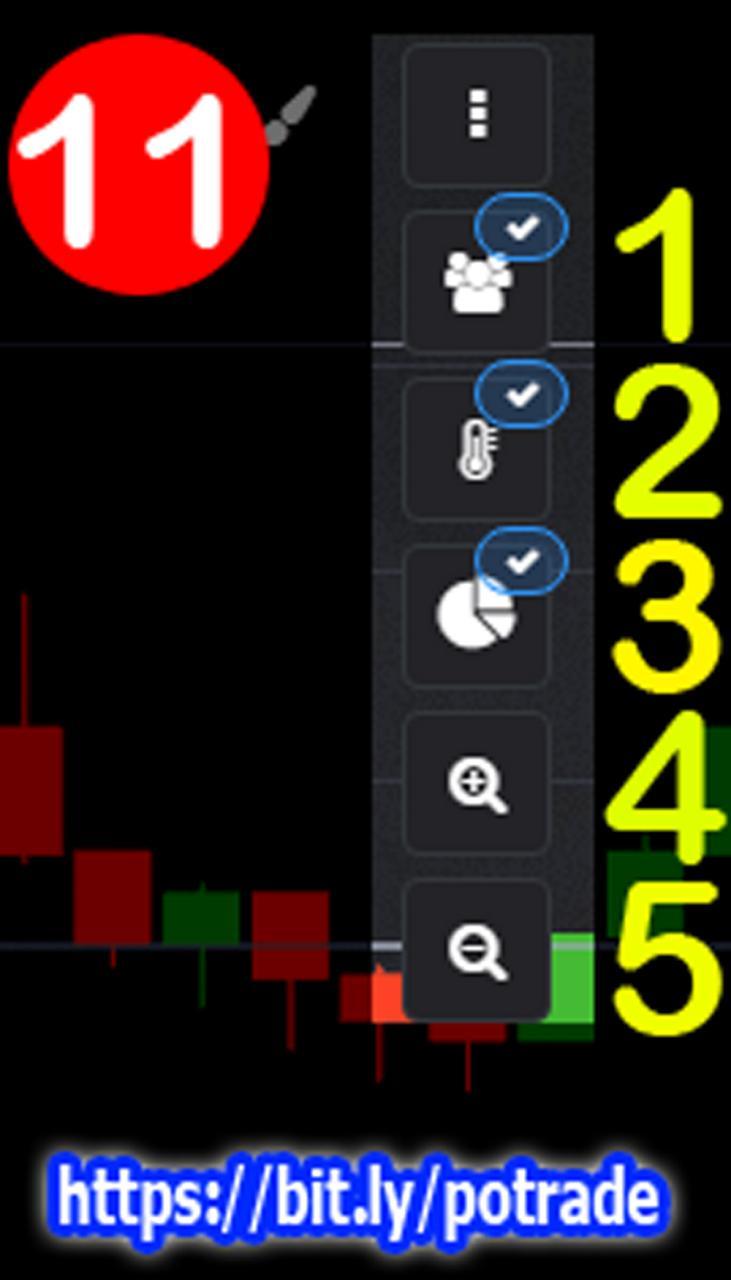

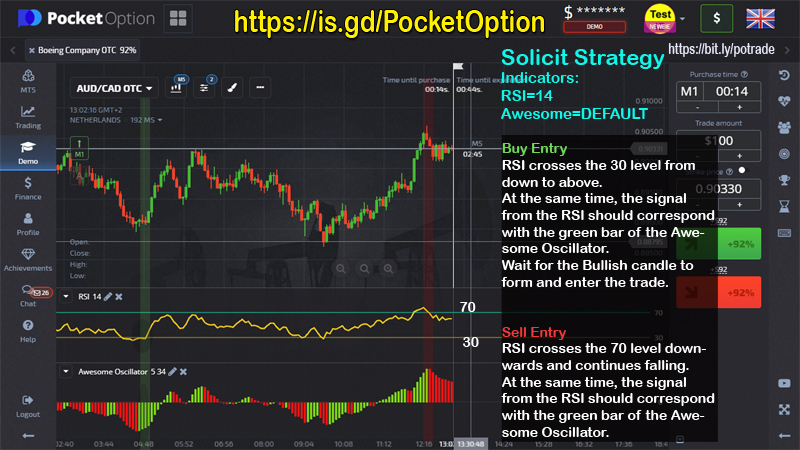

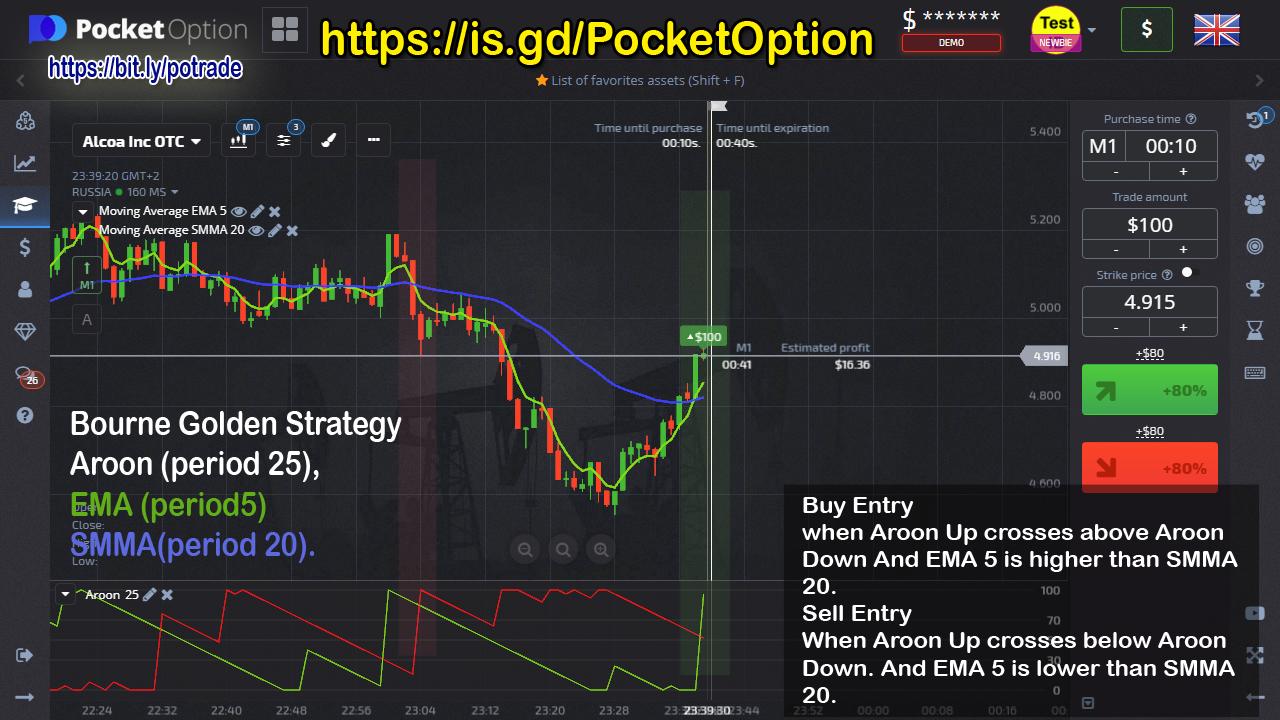

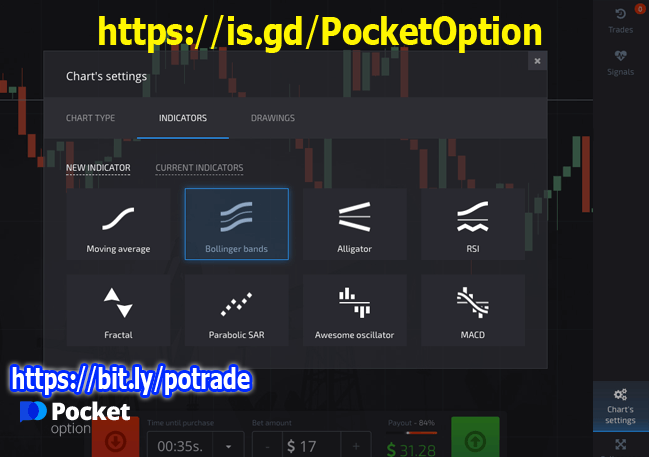

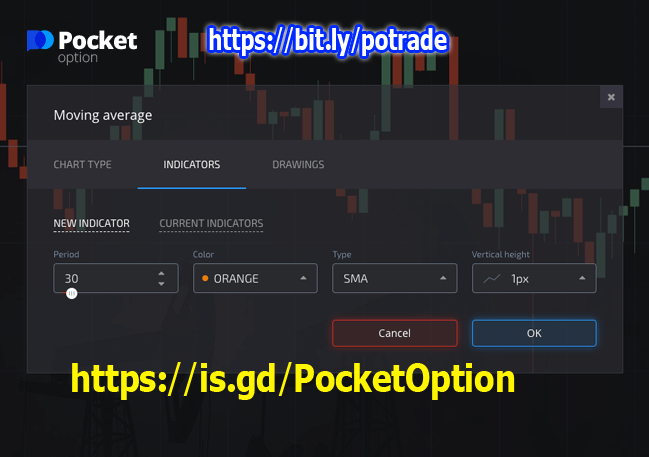

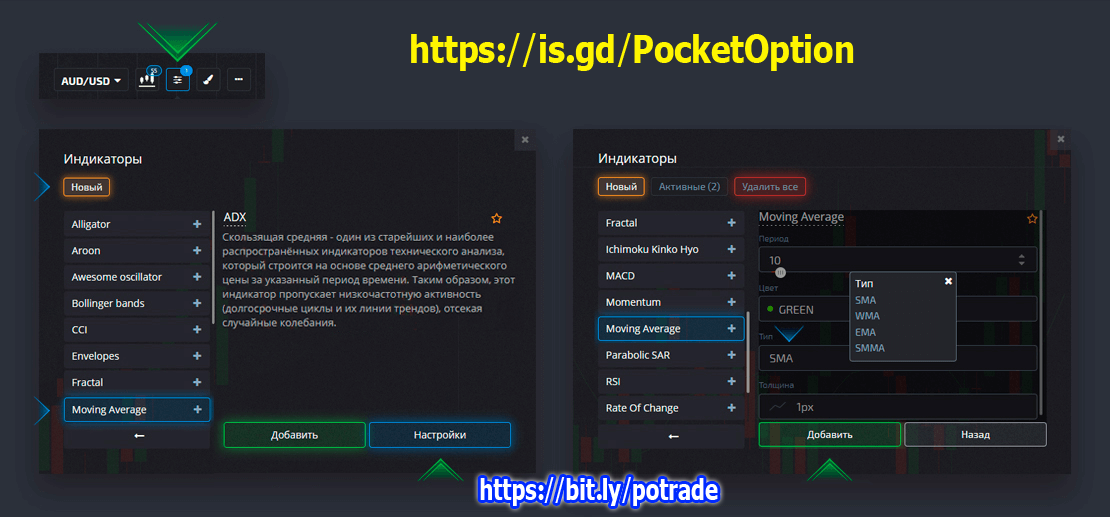

3. Computer analysis

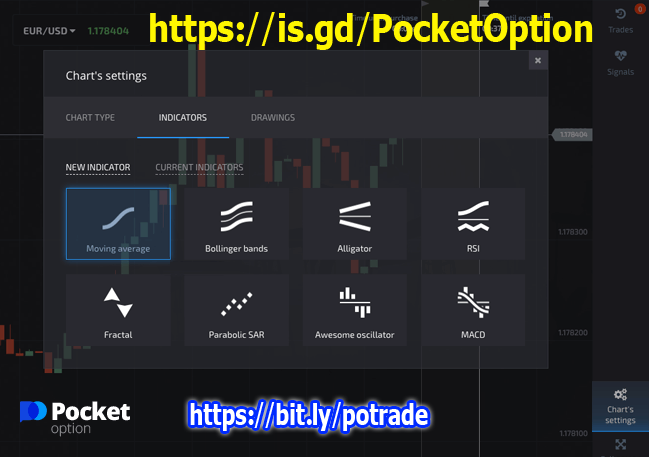

Computer analysis involves usage of technical indicators to spot trading signals and predict the price movement. Computer analysis considers the history of price changes which makes it quite a reliable choice. Among indicators' advantages is also their ability to determine a trend strength.

Moving averages is one of the basic but versatile instruments of computer analysis which will always have a place in the list of the most popular indicators. A signal for trend change is an intersection of the moving average with the price, and a signal for continuation of a trend is a bounce back of the price from the moving average level (here the indicator is used as a support or resistance level, depending on how the price is located in relation to it.) To spot these signals, it is recommended to use moving averages with long periods. However, it is important to select indicator periods individually for each trading instrument.

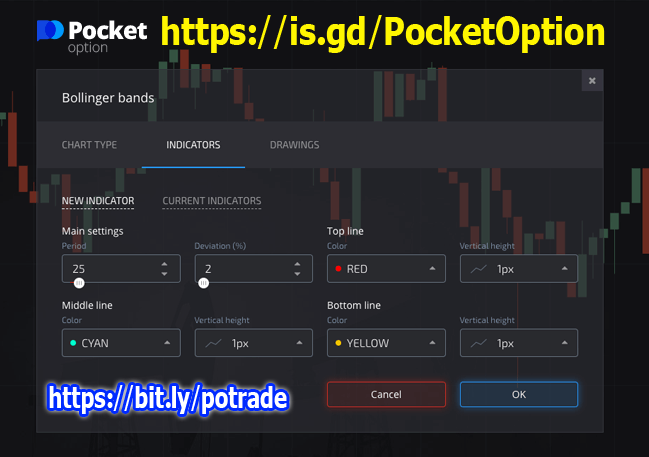

Bollinger bands are quite simple to use and can serve as a replacement for trend channels. The indicator represents the current price range. When using Bollinger bands the signals are received if the price goes beyond the indicator border - usually it's bound to immediately return to the center line of the indicator.

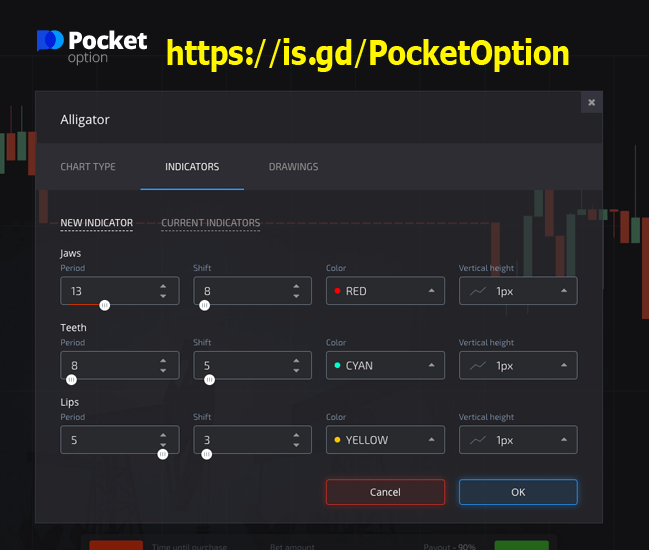

Alligator - this indicator is used to spot the beginning of a trend. However, it is not recommended to use it only as your main indicator, as it rarely provides signals to place a trade. Alligator lines can be used as support and resistance levels.

Indicators will prove to be quite useful in your trading process, as they allow you to quickly analyze the situation and make timely decisions. In addition, their code automatically calculates all of the required parameters and provides instant signals. But on the other hand, they need to be configured individually for each trading instrument.

4. News trading

As you might know, the market reacts to any significant financial, economic and political news. Depending on the significance of said news, after their publication the price may begin to change. News trading strategy is considered to be quite risky, but it allows you to make significant profits in just a couple of minutes.

Money Management

In addition to the main types of analysis, we recommend you to learn about money management strategies. This skill is extremely important for any trader who wants to achieve stabilized profits. The best money management strategy is loss tracking. It is necessary to initially determine the level of acceptable losses at which it is necessary to stop trading and revise the current trading strategy, since it has ceased to be effective. You can read more about money management here.

Conclusion

It is very important for novice traders to understand the basics of trading, as on this very foundation most of the variations of currently popular strategies and techniques are built.

Any trading strategy that you choose requires detailed studying and development of practical skills. You can use Demo account for these purposes. Regardless of your choice, it is also important to apply a money management strategy.

On our platform you will find descriptions of various trading strategies with detailed analysis and comments. Get invaluable practical experience and earn with us!

***